In today's dynamic and challenging business environment, effective financial risk management is paramount. Businesses across numerous industries in India are increasingly recognizing the critical need for robust risk management frameworks to mitigate potential threats and optimize performance. This is where skilled SAP TRM Consultants shine. As specialists in SAP Treasury and Risk Management (TRM), these professionals possess extensive knowledge of the system's functionalities and capabilities, enabling them to help clients implement tailored solutions that address their specific risk management objectives.

A proficient SAP TRM Consultant in India can assist organizations in streamlining their treasury operations, controlling financial risks such as commodity fluctuations, and enhancing overall financial stability. , Additionally, they can provide valuable insights and recommendations to help organizations make informed decisions that contribute to sustainable growth and profitability.

- The demand for SAP TRM Consultants in India is increasing at a rapid pace as more and more companies embrace digital transformation and seek to strengthen their risk management capabilities.

- Skilled SAP TRM Consultants are valued assets in the Indian market, offering a wide range of opportunities for career growth and professional development.

Unlocking the Power of SAP FICO in India: A Guide to Effective Financial Management

In today's dynamic business environment, organizations/enterprises/companies across India are increasingly relying on sophisticated software solutions to streamline their financial operations. Among these, SAP FICO stands out/emerges as a leading choice/is widely recognized for its robust capabilities in finance and controlling. Mastering this comprehensive system is essential for finance professionals aiming/seeking/aspiring to excel in the Indian market.

A deep understanding of SAP FICO's modules is crucial for effectively managing financial processes such as accounting, budgeting, reporting/analyzing/evaluating financial performance, and regulatory compliance.

Furthermore, expertise in the local regulations is essential for ensuring that financial operations adhere to legal/regulatory/compliance requirements within India.

By developing a strong foundation in SAP FICO, finance professionals can contribute significantly to the efficiency/effectiveness/success of their organizations/companies/enterprises.

Unlocking SAP FSCM Potential in India: Delivering Strategic Cash and Treasury Solutions

In the dynamic Indian market, businesses require robust cash and treasury management solutions to prosper. SAP FSCM offers a comprehensive suite of functionalities to resolve these challenges effectively. By exploiting the power of SAP FSCM, Indian enterprises can streamline their cash flow, reduce risk, and achieve a competitive edge. With its flexible design, SAP FSCM can be tailored to meet the specific needs of diverse industries.

A key advantage of SAP FSCM is its ability to provide real-time visibility into cash positions, enabling proactive decision-making. The system's robust reporting capabilities allow businesses to analyze their financial performance precisely. Moreover, SAP FSCM helps reduce risks associated with treasury operations by providing tools for forecasting cash flow and managing liquidity.

Moreover, SAP FSCM integrates seamlessly with other SAP modules, such as ERP and CRM, creating a holistic view of the business. This interoperability enhances efficiency and promotes data-driven decision-making. As India's business landscape continues to evolve, SAP FSCM will remain a valuable tool for organizations seeking to optimize their cash and treasury operations.

Leading SAP TRM Consultants: Global Expertise, Regional Impact

In today's rapidly evolving business landscape, organizations are seeking skilled consultants to navigate the complexities of Treasury and Risk Management. SAP TRM offers a comprehensive solution to manage financial get more info risks and optimize cash flows. To harness the full potential of this powerful system, companies require experienced consultants who possess both in-depth knowledge and practical industry insight. Expert SAP TRM consultants are in high demand, with their ability to deploy solutions that mitigate specific business challenges.

- Dedicated consultants bring a wealth of experience to the table, having successfully integrated SAP TRM solutions across diverse industries and geographies.

- They a thorough understanding of the latest industry trends and regulatory requirements, ensuring that organizations remain in line with best practices.

- In addition, top SAP TRM consultants provide ongoing support to ensure that systems operate smoothly and effectively.

Finding the right SAP TRM consultant can be a critical factor in the success of any implementation. By choosing experts with proven track records and strong industry connections, organizations can maximize their return on investment and achieve their financial goals.

Leading the Way with SAP FICO Consulting Services

In today's competitive business landscape, organizations demand robust and flexible financial management solutions. SAP FICO, a leading business resource planning (ERP) system, offers comprehensive tools to enhance core finance processes. Our team of SAP FICO certified advisors bring deep industry expertise and a proven track record of deploying successful engagements. We collaborate closely with our clients to analyze their unique challenges and design tailored SAP FICO strategies that support their business goals. From implementation to enhancement, our holistic services enable organizations to attain operational effectiveness.

FSCM Consultants: Streamlining Finance Processes Across Industries

In today's dynamic business environment, organizations demand robust and efficient finance processes to provide sustainable growth. Stepping into SAP FSCM consultants who utilize deep expertise in streamlining financial operations across numerous industries. These skilled professionals are able to configure customized solutions that optimize key finance functions such as accounts payable, accounts receivable, cash management, and audit.

- Leveraging their in-depth knowledge of SAP FSCM modules, consultants execute comprehensive assessments to pinpoint areas for improvement within an organization's finance processes.

- They design tailored strategies to automate financial tasks, decreasing manual efforts and improving overall efficiency.

- Additionally, SAP FSCM consultants provide ongoing support to ensure the smooth functioning of implemented systems, addressing any operational challenges that may arise.

Consequently, organizations benefit from increased financial visibility, reliable reporting, and more robust controls, ultimately driving financial strength.

Haley Joel Osment Then & Now!

Haley Joel Osment Then & Now! Bug Hall Then & Now!

Bug Hall Then & Now! Tonya Harding Then & Now!

Tonya Harding Then & Now! Catherine Bach Then & Now!

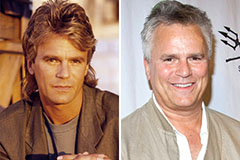

Catherine Bach Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!